All Categories

Featured

Table of Contents

The SEC asked for remarks regarding whether the monetary limits for the earnings and possession tests in the interpretation must be readjusted. These limits have actually been in location because 1982 and have actually not been readjusted to represent rising cost of living or other factors that have actually changed in the intervening 38 years. The SEC eventually decided to leave the possession and income limits the same for currently.

Please let us understand if we can be of support. To read the original alert, please go here.

Such terms go through alter without notification. To find out more on AngelList and its services and products, please see here - accredited investor corporation. Quotes included in these materials connected to AngelList's solutions must not be taken whatsoever as a recommendation of AngelList's advice, evaluation, or various other service rendered to its customers

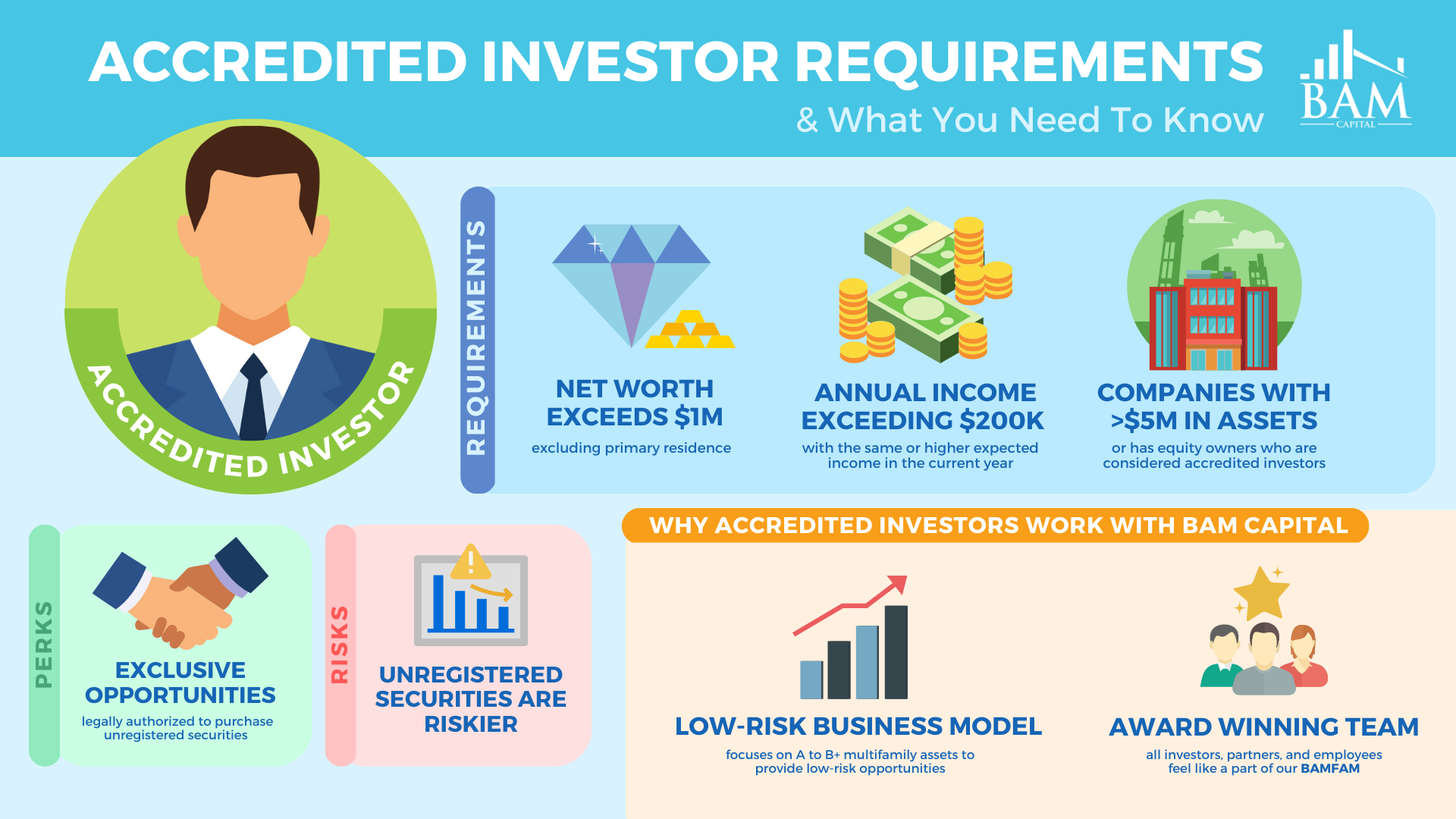

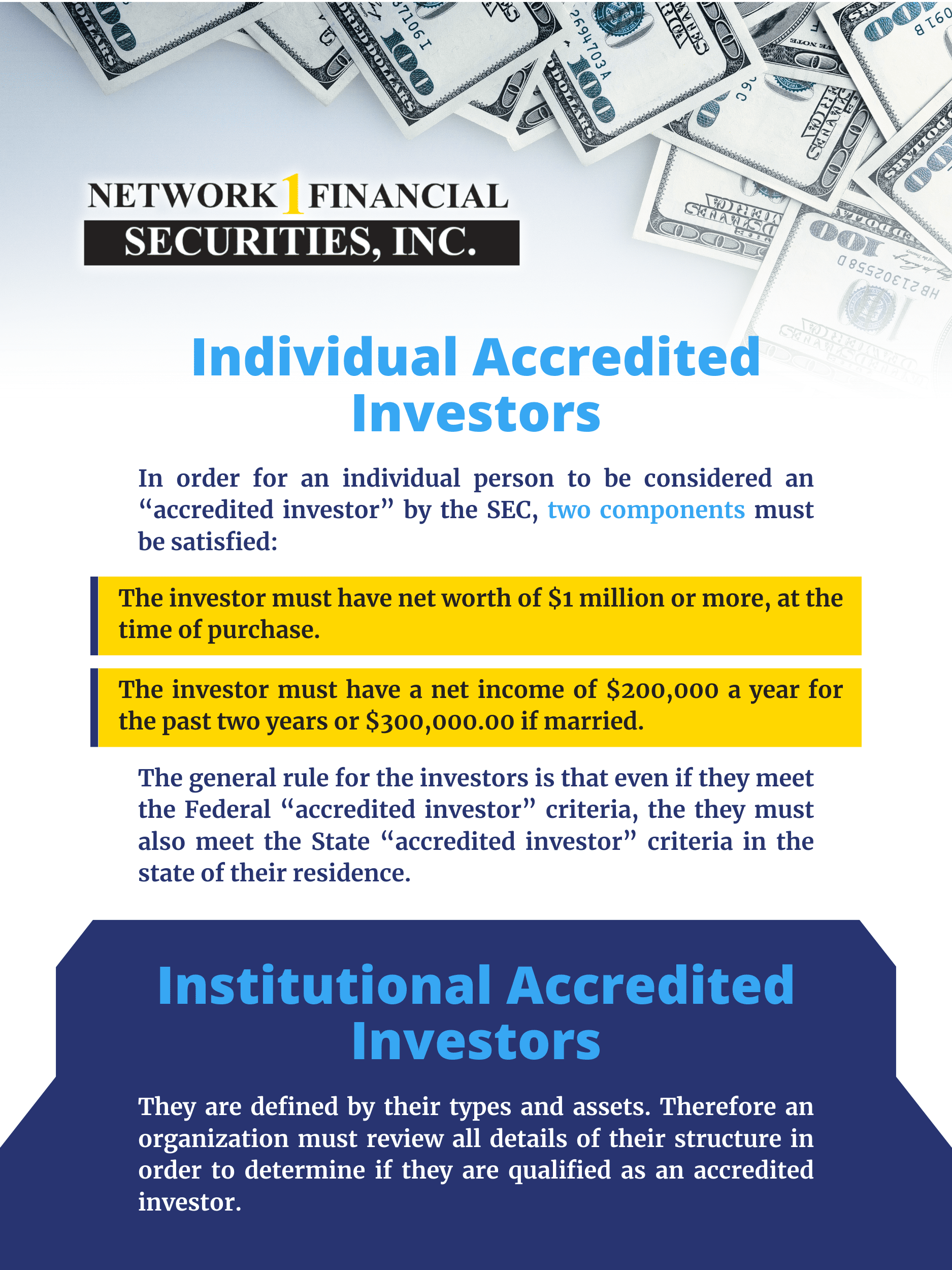

A certified capitalist is a specific or entity that has a certain level of financial elegance. The concept is that if investment opportunities limit involvement to financiers that can manage to take even more threat and are able to carry out due diligence on investment possibilities, there is much less of a requirement to sign up with organizations developed to secure private capitalists, especially the SEC.For people, there are 3 primary methods to certify as a recognized investor: By revenue: A specific financier can be taken into consideration an accredited capitalist if they have yearly earnings of a minimum of $200,000 for the previous 2 consecutive years and a practical assumption of reaching this income degree in the present year.

Accredited Angel Investor

By possessions: People can be taken into consideration accredited financiers if they have a total assets (assets minus debts) of a minimum of $1 million, not including their primary house. accredited investors llc. The $1 million threshold puts on both people and couples. By credential: People who hold a Series 7, Collection 65, or Series 82 permit are recognized financiers

For instance, a retired individual with $2 million in properties and really little earnings would certainly qualify. So if an individual had yearly earnings of $220,000 in 2021, $250,000 in 2022, and gets on track to earn $275,000 in 2023, yet only had a net well worth of $200,000, they would certify as an approved investor simply by revenue.

Supervisors, exec officers, or general companions of the business marketing the securities are likewise taken into consideration certified capitalists, no matter their earnings or possessions. And there are a number of methods that organizations or various other entities can qualify as accredited investors. For instance, corporations with greater than $5 million in possessions will certainly qualify.

As an example, many early-stage startups limit investments to accredited financiers, and there are numerous chances in business realty readily available specifically to certified investors. The usual motif is that these sorts of investments have incredible benefit potential. Visualize if you had participated in an early financial investment round for (0.9%) or (3.69%).

Qualified Investor Leads

The idea is that the SEC wishes to secure financiers that can't afford to tackle threats and soak up losses, or who don't have the economic class to completely comprehend the threats involved with investment chances. This is why financial investments that anybody can place their cash in (such as publicly traded stocks) are very closely seen by the SEC.

This procedure relies on the company of the safeties or financial investment opportunities. Some may confirm your accreditation standing themselves, such as by requesting for tax returns or asset statements. Some might just ask you to self-certify, while others could make use of a third-party verification solution, such as the details process, a lot of firms that provide unregistered investment opportunities take considerable steps to ensure that just certified capitalists get involved.

The biggest example of possibilities readily available to accredited capitalists is exclusive equity financial investments, such as financial backing deals or straight investments in early-stage companies. You may have heard of capitalists "getting in early" on business such as Red stripe, SpaceX, or others that are still private. Well, recognized financiers may have the ability to get involved in endeavor financing rounds led by VC companies.

The Motley Fool has placements in and suggests Meta Operatings systems and Tesla. The has a disclosure plan.

Is it your first time looking for information on exactly how to become a certified investor in the U.S., yet not certain where to start? The reliable day of the brand-new guidelines was December 8, 2020.

Regulators have stringent standards on that can be thought about a certified investor. Under brand-new legislation, individuals can now qualify as an approved capitalist "based upon actions of specialist knowledge, experience or accreditations in addition to the existing examinations for earnings or net well worth." To be considered a recognized capitalist, people will certainly need to supply substantial proof that personal net well worth goes beyond the $1 million limit.

Accredited Investor Database

Total web well worth needs to include all current properties that exceed the higher of $1 million. And these assets leave out the main residence and the worth thereof. The objective of governmental bodies like the SEC's regulations for financier accreditation is to offer defense to financiers. The accreditation need looks for to ensure that capitalists have sufficient knowledge to comprehend the risks of the potential investment or the finances to protect versus the threat of monetary loss.

There need to additionally be a reasonable expectation that they will certainly make the exact same or a lot more in the existing calendar year and the coming year. The second means a person can come to be an accredited investor is to have a total assets exceeding $1M. This leaves out the worth of their main residence.

Accredited Investor Solutions

Again, this is done either through income or by means of net worth financial declarations. An individual with each other with their spouse or spousal matching will be regarded certified capitalists if they have a pre-tax joint revenue of a minimum of $300,000 for the two previous years. They have to likewise be on track to make the exact same quantity (or even more) in the approaching year.

In addition, the SEC has actually provided itself the adaptability to reassess or add certifications, classifications, or qualifications in the future. The last of the primary ways that a person can be deemed a recognized investor is to be an experienced employee of an exclusive fund. Educated employees are defined as: An executive policeman, director, trustee, general companion, consultatory board participant, or person serving in a similar ability, of the private fund or an affiliated monitoring individual.

The complying with can likewise qualify as certified investors: Banks. A firm or LLC, not created for the specific objective of acquiring the securities provided, with total possessions in extra of $5M. Knowledgeable staff members of personal funds. Particular kinds of insurer. For a thorough break down of the different kinds of accredited financiers, please see the interpretations and terms made use of in Regulation D.

In the 1930s, government lawmakers were seeking a method to secure investors while likewise stimulating new company development. The Stocks Act of 1933 was established to regulate deals and sales of protections in the United States. The idea was to do so by calling for companies to sign up a statement with a selection of information.

Potential Investors Meaning

The registration needed to be considered effective before maybe provided to capitalists. Regulatory authorities needed to guarantee that only seasoned financiers with adequate resources were taking part for protections that were not registered. These opportunities do not drop under government or state protections legislations. Because of this, Guideline D of the Stocks Act of 1933 was developed and the term recognized financier was born.

Just capitalists that qualified as such would be able to take part in exclusive securities and private investment offerings. By doing so, they intended to strike a balance that would certainly boost service development and additionally secure less knowledgeable professional financiers from riskier financial investments. As these policies continue to evolve, the expertise and certifications needs come to be a growing number of important.

Table of Contents

Latest Posts

Tax Foreclosure Property Auction

Tax Property Sale

Real Estate Tax Liens For Sale

More

Latest Posts

Tax Foreclosure Property Auction

Tax Property Sale

Real Estate Tax Liens For Sale